The health insurance plans of the United States of America offers a variety of health insurance plans having some advantages and some disadvantages. As health insurance costs remain to be on the rise in a particular country, it is important to be familiar with the types of health insurance and how to select the right one. It is the hope of the authors of this all-encompassing guide on health insurance in the United States to help you learn all there is to know about health insurance including the types, how to sign up, and how to get the most from your policy.

Understanding Health Insurance Plans in the USA

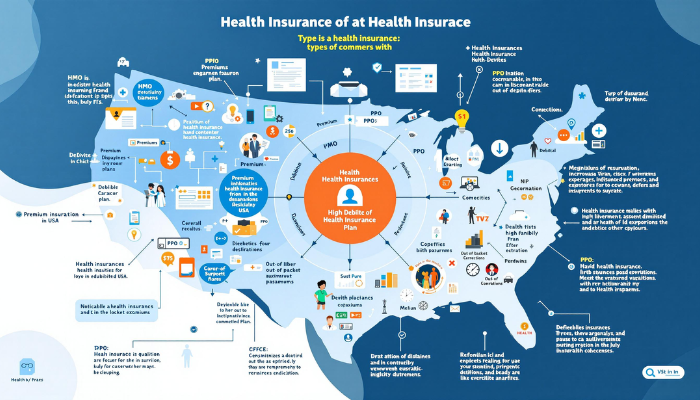

Independent of the health insurance plan, there are several forms of health insurance plans in the United States. These include:

1. Health Maintenance Organizations (HMOs): HMOs are a brand of health insurance plans, which offer first-dollar coverage in return for a regular membership fee. These plans make you select a gateway physician who acts as your main doctor and refer you to other doctors of your choice in special cases.

2. Preferred Provider Organizations (PPOs): PPOs are the other types of health insurance plan that offers less rigidity compared to HMO. A PPO is one in which treatments can be obtained from providers not under contract to the insurance plan without the need for a referral from a primary care physician. But you will have to dig deeper into your pockets when accessing health services not within the provider network of your plan.

3. Exclusive Provider Organizations (EPOs): EPO is a hybrid model of HMO and PPO, the payer’s choice that provides both options: limited to the network and out of network. Just like HMOs, EPOs compel the user to select an attendant doctor and you need a referral to seek the services of an expert. Yet, EPOs only pay for out of pocket service provider expenses for out of network services when such services are deemed necessary in emergencies.

4. High Deductible Health Plans (HDHPs): HDHPs are the health insurance plans that provide low premiums per month but have huge amounts that have to be paid for out of pocket before the insurance is used. These plans come with a Health Savings Account (HSA) or a Flexible Spending Account (FSA) which permits you to save your money with minimal taxes for recognized medical costs.

5. Catastrophic Health Insurance Plans: Major medical plans are intended to guard one against a major financial loss due to a major illness or injury. These plans have high deductibles and low premiums and affordable by those individuals who have no pre-existing conditions.

Factors to Consider When Choosing Health Insurance

When selecting a health insurance plan, there are several factors to consider, including:

1. Network: Always, check which doctors and hospitals your desired plans include to avoid having to pay more money out of pocket.

2. Coverage: Read over the specifics of the plan in question;orexamine the extent of prescription drugs, mental health and maternity care and so on in order to check if the plan is in a position to meet your needs.

3. Premiums and Deductibles: Analyse the monthly costs of premiums and deductibles in order to understand the total price and much money the client will need to spend on a healthcare.

4. Out-of-pocket Maximums: Think about identifying the out of pocket maximum of each plan, the maximum you will spend for health care services in a year.

How to Enroll in Health Insurance

Enrolling in health insurance can be done in a few ways:

1. Open Enrollment Period: To qualify for a special enrollment period the federal government offers an open enrollment period usually every November 1 to December 15 of the year where you can choose your health insurance plan. But you can only join this plan in a limited circumstance, typically only when you’ve had a life event that triggers a special enrollment period, such as losing other health coverage, getting married, having a baby, or adopting a child.

2. Through an Employer: It is common today to find many employees being given health insurance plans by their employers. If you are fortunate enough to have your employer offer health insurance then you can sign up during open enrollment or if you have a qualifying event.

3. Healthcare.gov: Government’s portal displaying health insurance for enrollment is Healthcare.gov where one can find and compare offered plans in a given location. This website will help you fetch the best plan according to requirement and bypass the financial constraints.

Making the Most Out of Your Health Insurance

To maximize your health insurance benefits, consider the following:

1. Stay In Network: When you Get treatment from in-network doctors, it’s easier to cut on expenses that you have to meet on your own.

2. Know Your Coverage: Make sure you know the position within your particular health insurance policy towards different diseases and disorders, including those it does not cover, those that are partially covered, and those it covers only under certain conditions.

3. Utilize Preventative Care: Get preventive care and screenings, so that if there is any health issues you experience them in early stages before becoming severe.

4. Review Your Claims: Another paper showed that line by line analysis of the claims and explaining can assist in reviewing your billing for any errors and inconsistencies.

Conclusion

In the US it would be beneficial if you understand the differences between various health insurance plans, and what type would be best for you. You can compare network and coverage, the premiums you will be paying, and the out-of-pocket costs to avoid when selecting your health insurance plan. Learn when to sign up for insurance which is during open enrollment or if you experience a major life change and avail of your insurance by sticking to in-network providers, understanding your coverage and using preventive care treatments.