Amid rising interest in decentralised finance (‘DeFi’), investors are noticing cryptos outside of the Bitcoin realm. While speculative, many offer potential growth opportunities through tokenomics, utility, and market narratives.

Keeping up with analysts’ watchlists can help newcomers navigate a fast-moving market, and identify coins with the best projected upside potential. Here are five worth considering:

Ethereum

Investing in altcoins is a way to diversify your crypto portfolio and support innovation. But it’s important to understand their risks and benefits before making a decision. While many altcoins offer higher profit potential than Bitcoin, they are also more volatile and have less stability. They’re also a great way to support blockchain projects that are trying to change the world. In addition to their high profit potential, many of these projects are pioneering new blockchain technologies. Some of these are even being used in real-world applications.

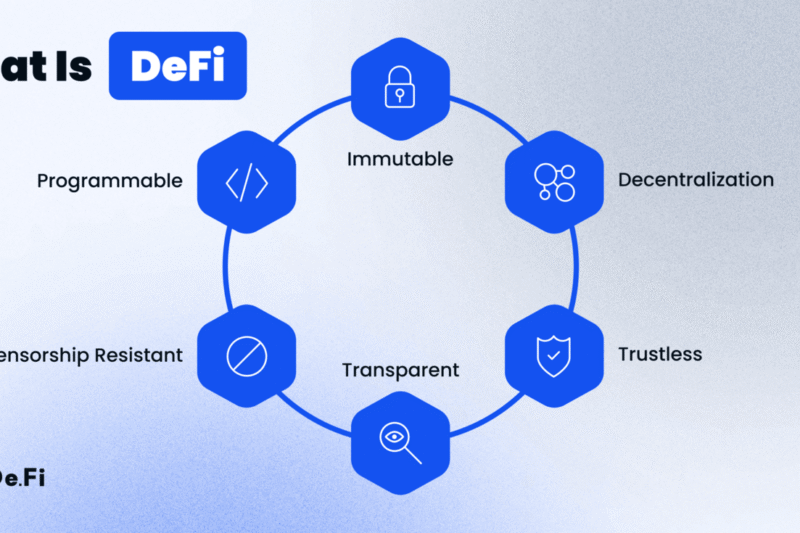

Ethereum is a blockchain-based development platform that supports decentralized finance (dApps) and non-fungible tokens (NFTs). It is designed to be scalable, programmable, secure, and decentralized. Its native cryptocurrency is ether, which powers transactions and computational services on the Ethereum network. This allows dApps to be created and run without the need for a central financial intermediary.

NFTs are digital assets that represent ownership of a unique item or piece of content. These can include digital art, real-world collectibles, virtual real estate, video game assets, and other types of media. They can be traded and stored in wallets. NFTs are being developed for a wide range of applications, including gaming and virtual reality. Ethereum is the leading platform for dApps and NFTs.

In addition to its scalability and security, Ethereum is working on several improvements that will improve the user experience. For example, it plans to reduce transaction fees and congestion. It also wants to add better support for smart contracts. It is also experimenting with other ways to scale its network, including oracles and layer-2 scaling solutions.

These innovations will allow Ethereum to compete with other platforms for the future of the Internet. It is already the leading platform for dApps and other innovative blockchain applications. The next step is to make it more accessible to a wider audience. Investors should focus on altcoins with strong developer ecosystems and growing real-world use cases. They should also consider whether they fit into the existing blockchain ecosystem. If not, they may need to create their own blockchain.

Solana

Solana is an alternative to Ethereum that aims to solve the pressing problem of blockchain scalability. Its hybrid Proof-of-History and Proof-of-Stake mechanism enables it to process thousands of transactions per second at low fees. This makes it an ideal platform for DeFi, NFTs and other decentralized applications that require high performance.

Solana’s scalability has gained it traction in the DeFi and NFT markets, as well as among blockchain-based gaming platforms. Its combination of fast transactions and low fees makes it an attractive option for developers. It has also attracted interest from major crypto exchanges and institutional investors.

Its technology is based on high-performance networking and optimized systems engineering, making it more scalable than many other blockchain networks. This is particularly important in industries like gaming, Web3 social networks and real-time financial services, where speed is essential. Its speed is enhanced by Proof-of-History, which functions as a cryptographic time stamp and reduces communication overhead among validators.

In addition, it has a modular tile architecture that allows for a flexible, fault-tolerant design. Its protocol is written in C/C++, which improves reliability and speeds up data handling. The system is currently running on a testnet, with the full mainnet expected to launch in 2025.

The project has a diverse developer community and is committed to transparency. Its roadmap outlines a number of features that will be implemented over the coming years. In particular, it will introduce a new consensus algorithm called Alpenglow, which is designed to address some of the network’s limitations.

Solana has a native token that is used to pay transaction fees and contribute to the network’s security. These fees are much lower than those charged on other platforms. Using the tokens, users can access apps and digital assets that work across the entire network. These assets can represent everything from currencies to ownership stakes in projects.

Another benefit of Solana is its global reach. Its decentralized model means that anyone with internet access can use it, regardless of their location or bank account. This gives small businesses in rural areas the same access to tools as those in major cities.

Ripple

The cryptocurrency market is diverse and dynamic, offering a wide range of investment opportunities. However, investors must exercise caution to avoid investing in altcoins that are speculative and volatile. They should carefully research the tokenomics, utility, and market potential of an altcoin before making a purchase. In addition, they should diversify their portfolios to minimize risk and benefit from various growth cycles. Investors may also want to consider crypto ETFs or staking for more stable exposure to the asset class.

Ripple is a blockchain-based digital payment network that facilitates transactions using its native token, XRP. The company offers a suite of solutions including payments, custody, and stablecoins to enable financial institutions to easily integrate blockchain technology into their businesses. Its global reach makes it an ideal platform for settling cross-border payments.

As a result, Ripple has become a leading choice for companies that want to improve their international payment processes. Ripple’s technology enables instant, direct transfers of money across borders, eliminating the need for intermediaries and speeding up the transfer process.

The XRP token can also be used to transfer value between different currencies, enabling financial institutions to bypass traditional banking infrastructure. The XRP crypto exchange rate is much more efficient than the bank-to-bank system, with transaction fees typically lower than 1%. The company’s blockchain-based platform also provides high liquidity, enabling it to handle thousands of transactions per second.

Despite its success, Ripple has faced regulatory challenges. The Securities and Exchange Commission (SEC) has sued the company for selling unregistered securities, causing its price to decline significantly in 2022. Ripple has responded by purchasing several other companies and assets, including crypto liquidity providers Metaco and Standard Custody & Trust, and developing new products to improve the user experience.

The company’s latest product is RippleNet, a modern network that uses the blockchain to support financial transactions. This solution enables global companies to instantly move, manage, and tokenize their value in a simple, secure, and compliant manner. This is a significant step forward for the blockchain industry, and it will have an impact on the way global commerce is conducted.

Litecoin

Whether your clients are asking about Ethereum staking or Ripple’s bank partnerships, they’re likely aware that the cryptocurrency market is more than just Bitcoin. While Bitcoin still accounts for the vast majority of trading volume, there are a multitude of altcoins offering unique features and functionalities to their ecosystems. Investing in these cryptos can offer an opportunity to diversify your portfolio and increase your exposure to cutting-edge technologies. However, it’s important to do your homework before investing in any altcoins. Ensure your coins are stored on reputable wallets or purchased through well-recognized exchanges, and stay informed about general crypto news on platforms like X (formerly Twitter).

Created in 2011, two years after Bitcoin, Litecoin was designed to be the “digital silver” to Bitcoin’s gold. It was designed to be fast and cost-efficient. Its blockchain is mined in a similar way to Bitcoin, but it has a smaller total supply. Unlike Bitcoin, which has a 21 million cap, Litecoin can be mined up to 84 million times. Like Bitcoin, Litecoin is a decentralized open-source global payment network with an integrated cryptographic protocol that facilitates secure and anonymous digital transfers.

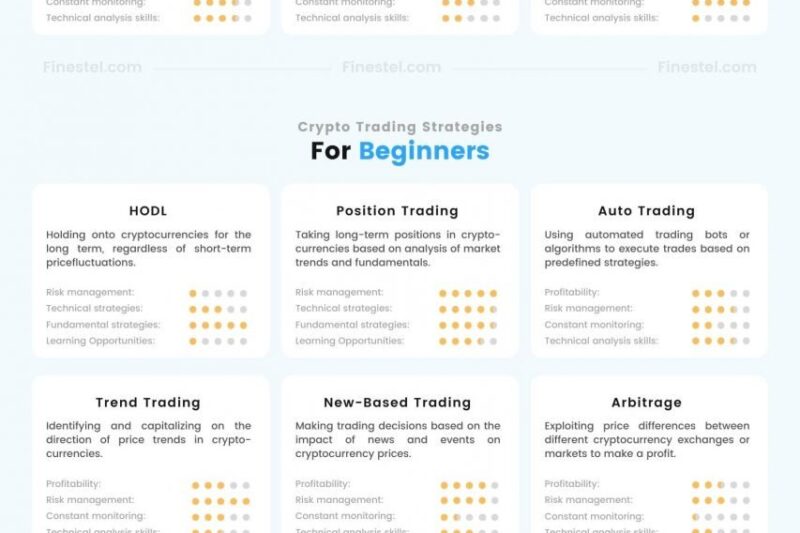

Before investing in any cryptocurrency, it’s critical to research the team behind the project and check their reputation in the crypto community. Some teams carry negative reputations from previous failed projects and may not be trustworthy. You should also consider whether the project has a track record of stability and resilience to crypto cycles. It’s also advisable to invest in projects that provide real-world utility to the cryptocurrency ecosystem. Proven narratives like Layer 1 blockchain platforms, Layer 2 scaling solutions, and Real World Asset (RWA) tokenization are great starting points.

Investors should be wary of new crypto projects that promise to generate high returns within incredibly short timeframes. These high expectations are often unsustainable and can lead to price crashes, which could have devastating impacts on your investment. Moreover, many of these new projects have unproven business models and fragile governance structures that can derail adoption. In addition, some of them have technical vulnerabilities that can severely impact their performance and price.