The US is an auto insurance compulsory country and every car owner and driver is obliged to have auto insurance. It has a protective function for the owner’s property as well as the rest of society from the possible consequences of hazardous road accidents. Given the available choices in the market, it becomes really difficult to select the perfect car insurance policy. , this article brings information on the features of car insurance and how you can get the best insurance company in the USA based on the different coverage types, and the factors that determine the car insurance cost.

Understanding the Types of Car Insurance Coverage

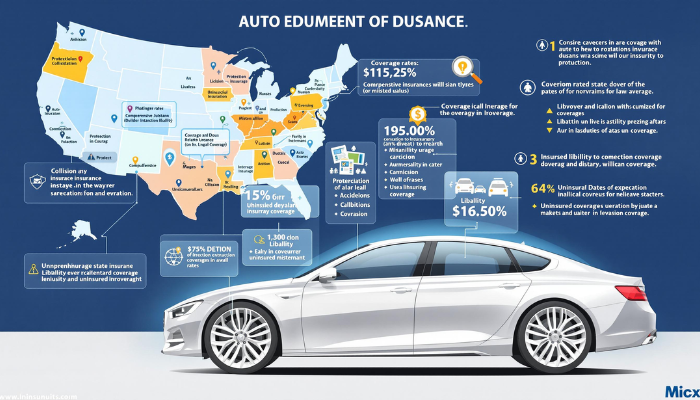

1. Liability Coverage: This kind of insurance is compulsory in every state/territory and pays for any property damage or bodily harm to others you cause in an accident. It is usually divided into two components: The compulsory ones are the Bodily Injury Liability Coverage, which compensates medical care and legal costs to the injured person and the Property Damage Liability Coverage for the damages to the other person’s property you are legally responsible for.

2. Comprehensive Coverage: While most people have car insurance, they do not cover damages that are not the result of an accident: theft, vandalism, fire, storms, or floods. This coverage is not compulsor but it is always a wise choice should you wish to protect your investment that is your car.

3. Collision Coverage: Collision coverage reimburses you for loss related to an accident with another car or object. That coverage is especially important if you drive a new or expensive car where the price of repairing or replacing the car would be costly.

4. Personal Injury Protection (PIP) or No-Fault Insurance: PIP insurance is required in some states and pays for all medical expenses and lost wages for you and your passengers, no matter whom was at fault in the accident. No-fault insurance rules your medical expenses and repairing your car no matter who was at fault in the accident.

5. Uninsured/Underinsured Motorist Coverage: This coverage shields you from a financial hit if a driver with little or no insurance hits your car; you buy this in increments called ‘limits.’

Factors Affecting Car Insurance Premiums

The car insurance premiums in the USA are calculated depending on several factors. Some of the most significant factors include:

1. Driving Record: In other words, people with a spotless driving history — no suspension of their license, traffic tickets or any entanglement in an auto accident — should pay less for insurance. Usually a premium is paid by those with a history of accidents or traffic violations.

2. Age and Gender: As a rule, they lie within the most dangerous categories in terms of insuring: young and male drivers will have to pay more. Insurance carriers’ premiums also reduce as the driver gains experience and or as he or she becomes older.

3. Credit Score: This rating is used by the insurers to calculate how likely a driver is to file a claim, or make a claim on the policy. In general, the drivers with the poor credit ratings pay more of the premium they are charged.

4. Vehicle Type: Insurance charges take into reflection the make, model and age of the car. For instance, while there are great reforms in offering a particular brand of automobile insurance to citizens, it has been realized that automobiles like high-performance or luxury vehicles, costlier to repair or replace, attract higher insurance premiums per head than economical cars.

5. Location: Probability: The number of accidents a certain area and their intensity can in some measure determine insurance premium. For the most part, drivers who pay more for their car insurance are coming from areas with high crime rates or being severely warded by traffic congestion.

Finding the Best Car Insurance Policy

1. Compare Quotes: Get insurance quotes from enough insurance companies to determine which policy is cheapest for your requirements. To get proper comparisons ensure that you are comparing policies that have similar coverage limits and deductions.

2. Research the Insurance Company: Before choosing an insurance firm, one should read all the reviews and make sure that the firm is financially capable of fulfilling the commitments once a client has a claim.

3. Understand the Policy: Understand policy working hours, the rate limits, and the deductibles, objective clause and any prohibitions.

4. Consider Additional Discounts: There are as many as 11 popular types of discounts that you can use to decrease the measure of car insurance, including the use of home or renters insurance, safety features in your vehicle, deficits, or defensive driving courses.

Car owners in the USA would need auto insurance as such it could be deduced. Thus, knowledge of the various forms of coverage, causes of varying insurance costs, and the approach to selecting the most appropriate policy is vital for personal wealth protection in the course of automotitive travel. Research to find best prices and compare them, and take time to go through the terms of the policy you intend to take.