With thousands of cryptocurrencies available, knowing where to begin can be intimidating. Most beginners start with well-known options like Bitcoin and Ethereum. These currencies are widely accepted and considered more stable than smaller, newer coins.

Then they must choose a crypto exchange, which is similar to an online stock market, and a wallet for storing their digital assets. Security is paramount. Hacks and scams are common, so it’s important to be cautious and follow tips like enabling two-factor authentication.

What is Cryptocurrency?

Cryptocurrency is digital money that runs on a virtual network. It’s not tied to any government or company, and it doesn’t exist in physical form like paper bills or coins. It’s often built using a system called blockchain, which provides a shared digital ledger for verifying transactions. In the decade since Bitcoin launched, many other cryptocurrencies have developed as alternatives to traditional money issued by governments or banks. Much of the interest in them seems to be driven by speculators trading for profit, and their prices can become quite volatile.

When you buy something using cryptocurrency, the transaction is recorded in a public ledger that’s incredibly difficult to tamper with, as each new purchase is verified by the rest of the network using encryption. These records are compiled into “blocks” that are added to the cryptocurrency’s blockchain, making them extremely secure and transparent.

These transactions can take place anywhere in the world, almost instantly and for low fees. They’re also able to bypass intermediaries like banks, making them more efficient and less expensive than traditional money transfers. But they lack the consumer protections offered by credit cards, and they’re not insured against loss by any bank or financial institution.

Some cryptocurrencies are designed to minimise volatility and improve their utility as a store of value by pegging their value to a fiat currency or a commodity like gold. These are known as stablecoins. Others are experimenting with ways to improve the functionality of blockchains or to add additional features that can make them more useful as a method of payment. For example, some are exploring the possibility of incorporating smart contracts, which would enable them to perform automated transactions.

What is Bitcoin?

Bitcoin is the world’s first cryptocurrency, a digital medium of exchange that operates independently from any central authority. Unlike credit cards or PayPal, which are controlled by private companies and require the involvement of a third party to process transactions, the Bitcoin network is open to anyone with an internet connection. It can be used to make a variety of purchases online, and its price has been volatile this year as it has established itself as a global player in finance.

Cryptocurrency is a broad term that refers to any digital currency that uses cryptography for security, but Bitcoin pioneered and is the best-known member of the category. It’s a bit like saying “apple” when you really mean “tree,” and it’s important to note that even though Bitcoin is a type of cryptocurrency, there are thousands of other types out there.

The technology that powers Bitcoin—and all other cryptocurrencies—is called blockchain, a giant digital database or ledger that records every transaction in chronological order. This information is distributed across the internet to computers running the Bitcoin software, and these computers work together (also known as mining) to verify and add transactions to the ledger. These transactions are then chained together using cryptographic functions, and the result is a secure record that’s accessible to everyone.

You own your Bitcoin in a digital wallet, which you can access from any computer that’s connected to the Bitcoin network. This wallet contains your various ’addresses,’ which are the equivalent of bank account numbers, as well as a secret code that allows you to send and receive bitcoins. The wallet also contains a private key, which is similar to a PIN number and helps keep your coins safe, though you should never lose it or share it with anyone.

What is Ethereum?

Ethereum is a platform that enables the creation of smart contracts and decentralised applications (dApps). The system also features a native cryptocurrency called Ether. The second-largest cryptocurrency by market capitalisation, Ethereum, sees noticeably more transaction activity than Bitcoin.

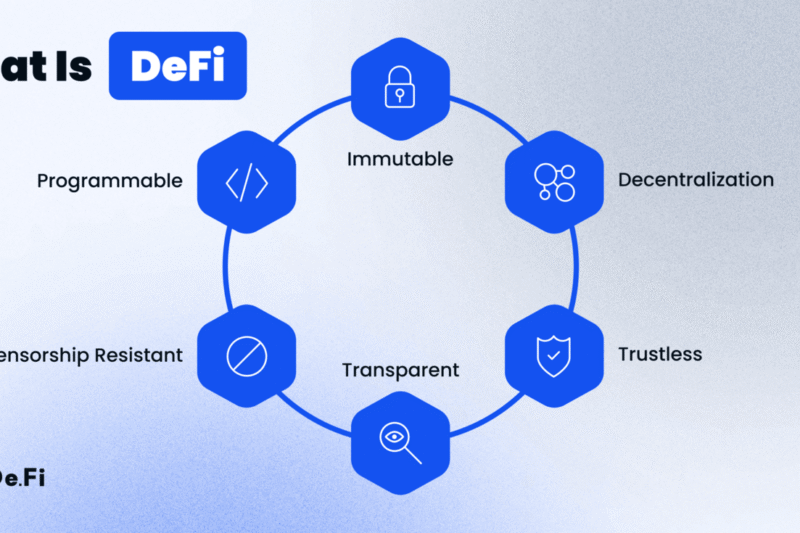

The Ethereum network functions as a global computer that processes and executes self-executing code, called smart contracts, in a transparent, secure, and tamper-proof way. This allows participants to create, verify, and enforce agreements that automate actions when predetermined conditions are met. This is all done without any central authority, eliminating the need for a trusted third party.

To maintain this decentralised computer, the Ethereum network relies on a global community of computers that run its software. These computers, known as nodes, validate transactions and add them to the blockchain. Nodes invest a lot of money into hardware and electricity to participate, but they are rewarded with the Ethereum token, or ether, for their efforts. These ethers are then used to power computational services on the network, including processing transactions. Transaction fees on the Ethereum network are referred to as gas rates and can vary depending on how busy the network is.

Unlike Bitcoin, which was designed primarily as a digital currency, Ethereum was developed to be a general-purpose platform for dApps, smart contracts, and other blockchain solutions. Its value is driven by its flexibility and scalability, and it typically sees spikes in demand during periods of economic uncertainty when people turn to Ethereum for stablecoins, decentralised finance (DFi), or other uses that require a more robust blockchain solution.

Like Bitcoin, Ethereum is a blockchain-based system that relies on a Proof-of-Stake (PoS) consensus mechanism to record and validate transactions. PoS differs from PoW, as it uses less energy and involves actors called validators that are incentivised to propose new blocks by locking up a percentage of their ether as collateral, which can be confiscated if they fail to validate a block.

What is Litecoin?

Litecoin (LTC) is a cryptocurrency built for speed and efficiency. It operates on blockchain technology like Bitcoin and uses a proof of work system, but was designed for daily use with faster processing times and lower transaction fees than its peers. Often called the “digital silver,” Litecoin has become popular for everything from airline tickets and groceries to rent payments through platforms like BitPay. Its low fees also make it an ideal choice for micropayments and point-of-sale transactions. Additionally, you can earn yield and interest on your Litecoin investment via third-party staking platforms and decentralised finance (DeFi) protocols.

Originally launched by former Google engineer Charlie Lee in 2011, Litecoin was created to be an alternative to Bitcoin, with increased speed and lower transaction fees. Its maximum supply is 84 million coins, quadruple that of Bitcoin, and its block time is 2.5 minutes, allowing for on-chain transactions to be processed quickly and more cheaply than its rival. It is also programmed to halve its mining rewards every 840,000 blocks, slowing inflation and deterring speculation.

The Litecoin community continues to push the coin forward. Its likeness to Bitcoin makes it a useful test protocol, and its developers have launched features such as the Lightning Network and Segregated Witness before integrating them into the Bitcoin blockchain. Whether or not the coin has a future remains to be seen, but its popularity suggests it’s here to stay.

As with other cryptocurrencies, Litecoin is mined using independent computers around the world to add transactions to its blockchain. These computers are rewarded with new Litecoins in exchange for the work they perform. As of May 2024, the network has processed more than 34 million transactions. In addition, the coin has a unique feature called MimbleWimble Extension Blocks, which makes it possible for only the sender and recipient to see the details of each transaction.

What is Ripple?

The company Ripple provides blockchain services and technology for financial companies. The company is based in the United States and is privately owned. Ripple offers solutions that leverage cryptocurrency, a ledger, and a native digital asset called XRP to enable businesses to perform secure, low-cost global transactions.

The Ripple network operates using a consensus mechanism that eliminates the need for mining, which expends energy and computing power to mint new coins or validate transactions. As a result, the network is considered to be more decentralised than other cryptocurrencies, although some argue that Ripple still has too much control over the XRP Ledger.

Like Bitcoin and Ethereum, XRP is a cryptocurrency that can be purchased on crypto exchanges. To buy a coin, you must first have a cryptocurrency wallet. These are software programs or mobile phone apps that allow you to store your coins securely and in an encrypted form. Wallets can be bought online or through a cryptocurrency exchange. Regardless of where you buy your XRP, it is important to store it in a secure wallet to prevent your coins from being stolen.

Ripple provides blockchain-based cross-border payments and liquidity solutions for enterprises, including banks and other financial institutions. Its products include the XRP ledger and a stablecoin backed by US dollars called RLUSD. Ripple also offers an enterprise-focused version of its blockchain platform that is designed to help businesses reduce costs and speed up international transactions.

The company has created a payment network called RippleNet, which is used by many large banks and money transfer services to facilitate international transfers. The platform is designed to be more cost-effective and faster than existing financial infrastructure, such as SWIFT. It allows for the exchange of a wide range of currencies and even commodity-based fiat currencies, and only charges a very small transaction fee to use its system.