Introduction

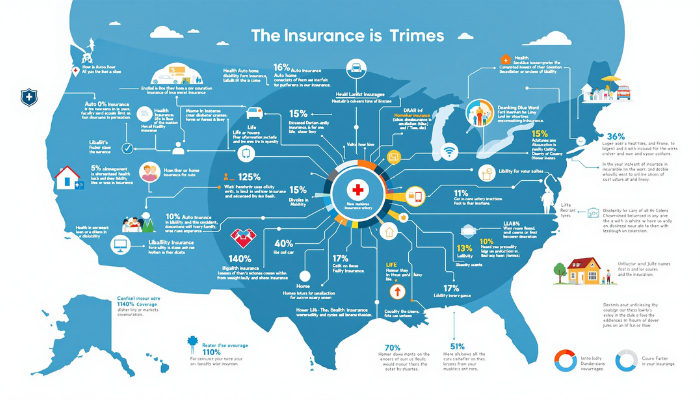

Insurance is a critical social armor in the United States of America especially for individuals and companies. After reviewing the current literature on insurance, it was found that it serves as means of financial security against incidences which are w(cont’d) unexpected and circumstances that may lead to financial losses. American insurance consumers have numerous options to choose from due to the variation in the kind of risks they face. Here, we present an overview of the principal kinds of insurance in the United States, as well as the purpose of each.

1. Health Insurance

Having health insurance in the US is really important since doctors’ bills and other costs related to it can be very, very high. They are hospital, consultation fee, drugs, and any other cost associated with health. Employer-Sponsored Health Insurance is the biggest category of health insurance commonly offered in the United States and the other categories include individual health insurance on or off Health Insurance Marketplace and lastly government health insurance this includes Medicaid and Medicare.

2. Life Insurance

Endowment insurance is a contract where the policyholder pays an agreed amount many times called a premium in exchange for a larger amount referred to as the face amount upon the policyholder’s death. It is mainly employed to provide an income replacement, make funeral expenses, and clear liabilities. The most common types of life insurance are Term (a Life Insurance), Whole (a Life Insurance), Universal (a Life Insurance) and Variable (a Life Insurance).

3. Homeowners Insurance

This type of insurance does cover the homeowner against financial loss arising for instance from damage to the property or for bodily injury to another occurring within the homeowner’s premises. It encompasses the losses in the house, furniture, computer, other structures in the compound for example the garages or sheds. Homeowners insurance also pays for liability suits that arise out of an accident like a visitor who slips and falls in the homeowner’s house. The everyday hazards to be named in homeowners insurance include fire, windstorm, hail, susceptibility to theft, among others.

4. Auto Insurance

Almost all of the states in US requires auto insurance and it pays for damages because of auto accidents. This policy covers medical bills, loss liability for any physical harm or property damage for which the driver is liable, and for which he is accountable. The minimum mandatory amount of coverage differs from state to state and there are numerous options of auto insurance: liability auto insurance, collision auto insurance, comprehensive auto insurance and final one is the personal injury protection auto insurance.

5. Disability Insurance

Sickness and disability insurance pay benefits if one cannot work because of a sickness or an injury. The additional income can also support paying the bills like homo, utilities, groceries, and numerous necessary medical costs. There are two primary types of disability insurance: temporary disability insurance, which pays out only for a few months and permanent disability insurance that can pay for several years or till the end of the policyholder’s life.

6. Liability Insurance

Liability insurance keeps a person or company from having to pay for claims that stem from injuries or harm that were in some way induced by him or her or the business when running operations. This may be general liability insurance which is insurance against third party risks common to business like accident on your premises or product liability and professional liability insurance covering mistakes or oversight in professional services. Business people utilize various kinds of insurance, and for individuals; it is still effective, and those involved in risky jobs should consider this type of insurance.

7. Flood Insurance

Flood insurance is a special kind of insurance needed for homeowners in the states which are often flooded, or in the regions exposed to hurricanes and tropical storms. Typically homeowners and renters insurance don’t cover flood damages and therefore the policy holder is required to purchase flood coverage. The NFIP has subsidized premiums for properties located in participating communities and many property owners can purchase flood insurance from NFIP participating companies.

Conclusion

To sum up, thus can be presented insurance types in the USA classification based on their purpose and the customer’s risk level. Every insurance is a safety net to people and business individuals as they plan on health, life, homeowners, auto, disability, liability, and flood insurance. Understanding these different types of insurance and the types of cases where it applies is what makes finding the correct insurance management possible.