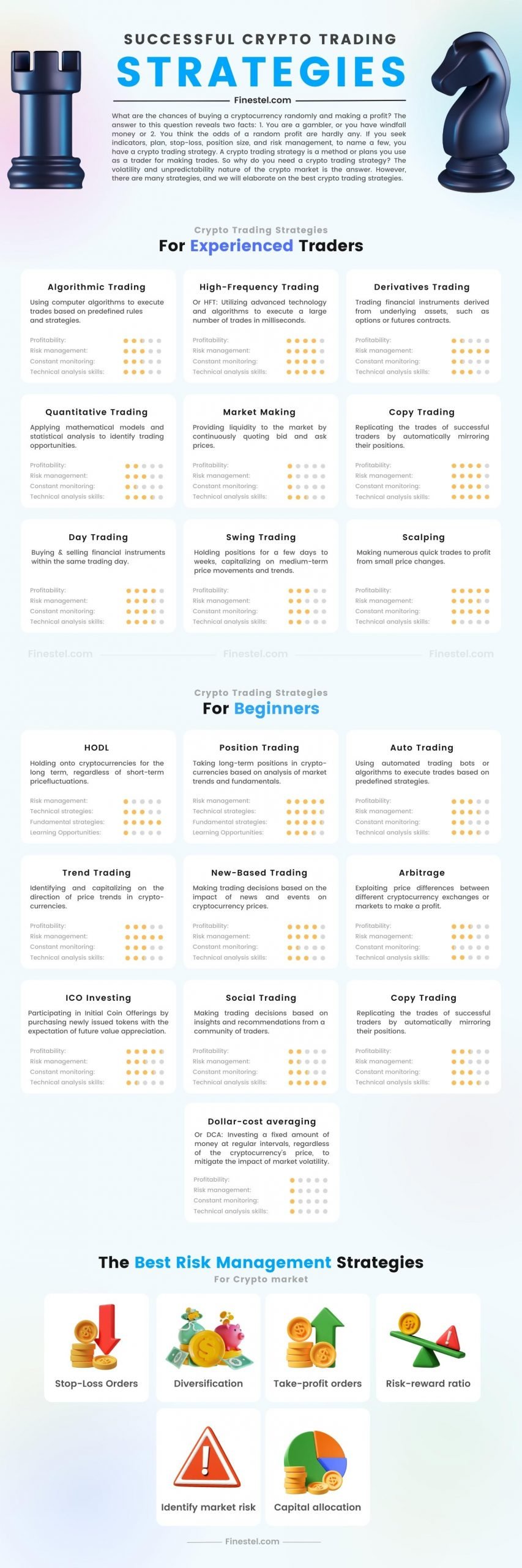

The right crypto strategy depends on your financial goals, market outlook and risk tolerance. However, all strategies require research, self-discipline and an understanding of trading fundamentals.

Day trading aims to profit from small movements in cryptocurrency prices and requires an intense focus, fast decision-making and the use of charts or tools. HODLing, on the other hand, involves patience and the belief that crypto will rise over time.

Long-Term Growth Potential

When deciding whether to day trade or hodl crypto, it is important to evaluate your own risk tolerance, time availability and financial goals. Both strategies offer unique advantages and risks. Day trading can deliver faster returns, but it requires more frequent monitoring and is more susceptible to emotional pressure and financial risk. The HODL strategy, on the other hand, offers slower returns but is less risky and provides a more stable source of income over the long term.

The HODL (originally a misspelling of “hold”) strategy is an investment philosophy that prioritises strong fundamentals and long-term growth potential for cryptocurrencies. It’s a strategy that many crypto investors use to grow their investments.

HODLing involves buying and holding cryptocurrencies for extended periods, regardless of market volatility. HODLing can help beginners invest in cryptocurrency without investing a lot of capital or time. It requires patience and discipline, as investors must ignore daily price fluctuations and focus on the future potential of cryptocurrencies. However, HODLing also has its disadvantages. For example, if the cryptocurrency you’re holding doesn’t have strong fundamentals or a viable business model, it could lose value over time.

To maximise their long-term growth potential, HODLers can practice dollar-cost averaging, or DCA. This strategy involves entering small positions over an extended period of time, rather than purchasing large positions at once. This reduces overall risk and allows you to diversify your portfolio. DCA is particularly beneficial for HODLers because it helps mitigate the impact of price volatility.

Another key aspect of the HODLing strategy is choosing which coins to hold. Typically, hodlers choose to invest in the top ten cryptocurrencies by market capitalisation. This can help them minimise losses, as the higher-cap coins tend to have more stability and a longer track record of success. Additionally, hodlers should take steps to ensure their digital assets are secure by using a secure wallet and practising good cybersecurity practices.

When considering whether to day trade or HODL, it’s important to assess your own skills, risk tolerance and time commitment. If you have advanced technical trading skills and can dedicate more time to monitoring the market, then day trading may be a better option for you. Otherwise, HODLing is a more suitable choice for beginners with limited resources and who are comfortable with a low-stress, long-term investment approach.

Lower Transaction Costs

HODLing involves buying and holding crypto assets for extended periods of time, typically weeks to months or even years. It’s a strategy that appeals to investors with a more conservative risk tolerance and long-term investment horizon. This approach may yield modest gains over a longer period, but it can also miss out on short-term trading opportunities and expose you to the potential for lower returns through higher volatility.

Unlike day trading, which involves buying and selling digital assets on the same day to take advantage of rapid price fluctuations, HODLing offers the benefit of fewer transactions,whichlowerser your transaction costs. Additionally, HODLing doesn’t require daily market monitoring, which can reduce your stress level and prevent you from reacting emotionally to sudden price dips.

However, HODLing does have its downsides, including the possibility of lower returns due to prolonged bear markets, the loss of opportunity cost (because you’re not able to participate in short-term trades) and the risk that some cryptocurrencies won’t survive for long. To mitigate these risks, rebalance your portfolio by regularly acquiring new assets, diversifying your holdings and deploying tools like Token Metrics’ AI-driven coin ratings to ensure that the tokens you hold have the strongest long-term growth potential.

Both strategies offer a range of benefits, and the decision comes down to your own personal situation and risk tolerance. If you’re comfortable with high-risk, high-reward scenarios, day trading could be suitable for you.

Ultimately, both strategies offer the potential to deliver substantial profits, but the key is to conduct thorough research, stay well-informed and diligently manage your risk. Never invest more than you can afford to lose and avoid leveraging debt to finance your investments. If you’re unsure about which strategy to pursue, consider splitting your portfolio into two portions and designating one portion for hodling capitaliseize on the long-term growth potential of crypto assets while allocating another to trading to exploit short-term opportunities. By taking a balanced approach, you can maximise your opportunities without exposing yourself to unnecessary risk.

Less Stressful

Cryptocurrency prices are incredibly volatile, making them a high-risk investment. HODLing, which stands for “hold on for dear life,” involves buying cryptocurrency and holding it over the long term, despite market fluctuations. This strategy requires patience and discipline, but the potential for large gains over time makes it an attractive option for those looking to grow their portfolios without the risk of short-term losses. Moreover, HODLing is less stressful than day trading, as it requires fewer transactions and a lack of daily market monitoring.

The term HODL, which originated as a misspelling in a 2013 Bitcoin forum post, has become an important part of crypto culture and an essential ethos for investors. Its popularity is due to its ability to convey the idea that cryptocurrencies have significant long-term value and are worth weathering short-term price drops. It also emphasises the importance of staying calm during periods of increased volatility and resisting the temptation to sell in a panic.

While HODLing can be less stressful than day trading, it is not without its risks. It is crucial to diversify your investments to reduce the likelihood of becoming overly reliant on any single asset and to remain informed about the cryptocurrency market and technological developments. Moreover, it is important to use secure wallets to prevent the theft of your crypto assets.

In addition, if you sell your assets for more than a year, you may be subject to capital gains taxes. While these taxes are typically lower than short-term tax rates, they can be a significant burden for some investors.

Ultimately, it is up to each investor to decide which strategy best suits their financial goals and comfort level with risk. Day trading can provide quick returns on invested capital, but it is a high-risk strategy that requires a high level of knowledge and fast decision-making. Alternatively, HODLing offers long-term growth potential with lower transaction costs and is more suitable for those with limited time or technical skills for day trading. However, both strategies can be effective for growing your cryptocurrency portfolio. It’s just a matter of finding the right balance for your own personal situation.

Less Risky

If you’re planning to hold your crypto for the long term, HODL is likely the right strategy. HODLing draws inspiration from the traditional buy-and-hold investing strategy that’s used in stock markets, but it applies to cryptocurrencies, which are often speculative and subject to extreme price fluctuations. HODLers believe in the potential of cryptocurrencies to redefine finance and transform society, and they’re willing to weather volatility for long-term gains.

Ultimately, the decision to HODL or day trade depends on your investment skills and goals, risk tolerance, and time commitment. Day trading can generate greater returns than HODLing, but it’s also more stressful and requires more frequent monitoring of the market. In addition, tax compliance can be complex for day traders, who must keep track of all their transactions and manage a portfolio of multiple currencies.

The phrase “HODL” first appeared in a 2013 post on the BitcoinTalk forum by aauser with the username GameKyuubi, who mimisspelthe word hold. The typo soon became a viral meme and a rallying cry for those who want to preserve the value of their crypto investments. Despite volatile prices, HODLers are confident that their assets will increase in value in the long run.

This belief stems from the fact that cryptocurrencies are incredibly scarce and in high demand, making them less likely to be devalued by inflation or regulatory changes. HODLers also see potential for emerging use cases that could boost demand, and they’re convinced that the blockchain technology that powers cryptocurrencies will continue to grow and evolve.

Whether you choose to HODL or day trade, thorough research and careful consideration of your financial goals are essential for success. You should never invest more than you can afford to lose, and if you’re considering a hybrid strategy, you should always seek advice from a professional or experienced investor. With tools like Public, you can find a wealth of information on investing in crypto and create a plan tailored to your financial objectives. Happy investing!