Decentralised finance is transforming the financial landscape by introducing new ways to manage and invest assets. It also allows for greater transparency and security.

However, the DeFi ecosystem is not without its challenges. Several risks have emerged, including phishing attacks and oracle manipulation. These risks can be mitigated through rigorous testing and regular security audits.

Decentralization

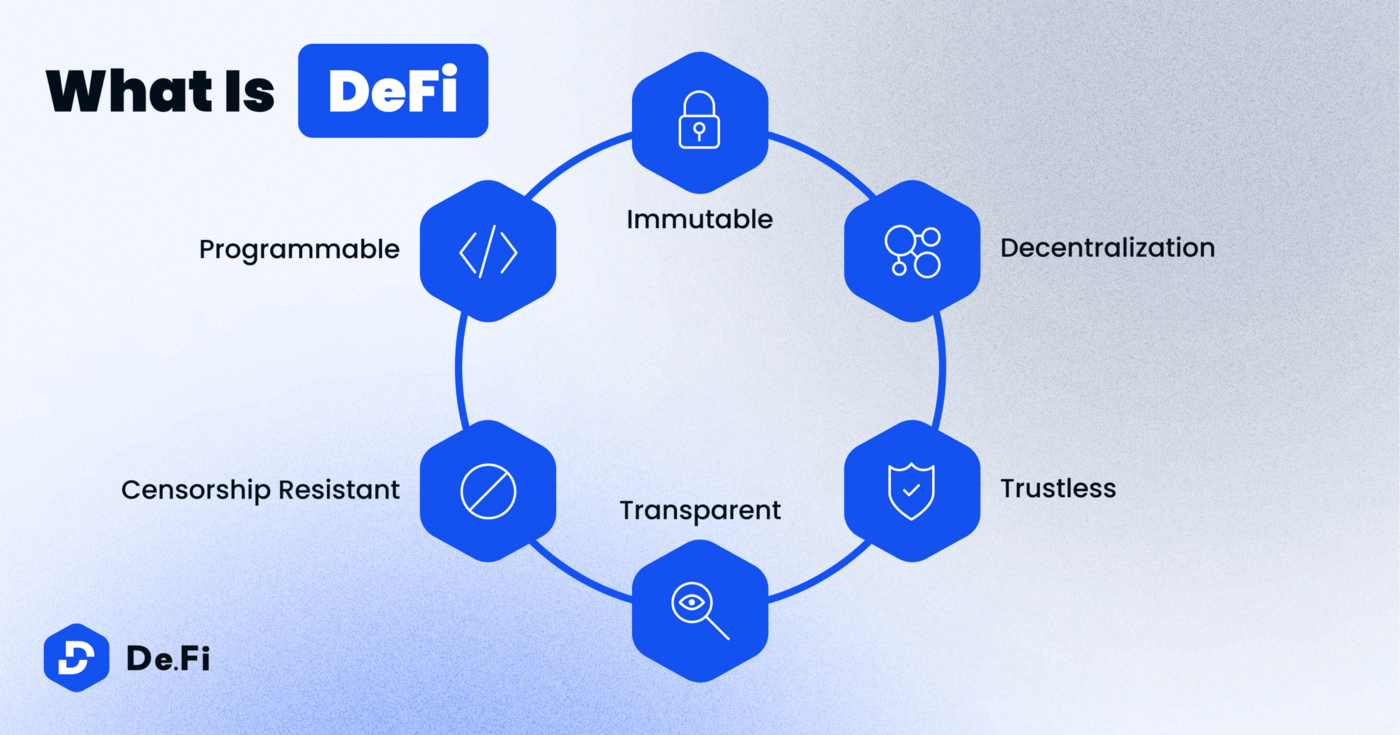

Decentralised finance is a new system that allows people to trade, invest, save and borrow without the intervention of banks or other financial institutions. It uses blockchain technology to remove intermediaries and enable peer-to-peer transactions that are transparent, secure, and censorship-resistant. It is also a cost-effective and efficient way to manage money, and it can help to connect different economic sectors that would otherwise operate independently.

Traditional financial systems rely on centralised institutions that control access to funds and impose high fees and strict regulations. DeFi uses the power of smart contracts and blockchain networks to eliminate these intermediaries and allow people to exchange assets directly. This can lower registration barriers and transaction costs, and it can also provide more competitive rates for loans and investments.

Another advantage of DeFi is that it reduces the need for trust between users and service providers. This can improve due diligence and help reduce fraud and scams. Moreover, it is possible to verify transaction details through public blockchains, which offer transparency and security.

However, it is important to note that the success of DeFi depends on the quality of the data it uses. If the information is inaccurate or outdated, a smart contract could be hacked. This is why dApps need to source premium off-chain data from trusted sources.

Moreover, DeFi can bring financial inclusion to remote areas that are currently unable to access traditional banking services. This is because it provides a reliable, scalable solution to transfer value and make payments. DeFi is becoming increasingly popular and is set to revolutionise the financial industry in the coming years. As the DeFi ecosystem grows, it must maintain a high level of security. This includes implementing robust cybersecurity protocols and ensuring that all DeFi platforms can withstand hacks and attacks.

Transparency

Decentralised finance is a new wave of financial innovation that uses blockchain technology to give users more control over their assets. It promises to reduce costs, enhance security, and open up avenues for the underbanked to access services. It also offers a more transparent financial system that’s free from the risks of centralisation. But like all technologies, DeFi has its share of challenges. These challenges reach into the legal sphere and touch on interoperability and transaction speeds.

The most significant challenge facing DeFi is scalability. DeFi applications are often built on top of public blockchains, which require a large amount of data for consensus security and other functions. These processes are complex and time-consuming, making it difficult to develop a secure and scalable system. DeFi is also reliant on external data to execute its contracts, such as prices and interest rates. However, these sources can be manipulated, which introduces systemic risk to the ecosystem. This risk can be mitigated by using high-quality oracles that avoid manipulation.

Despite these risks, DeFi offers many benefits for businesses. For example, it can lower the cost of cross-border transactions and increase speed and efficiency. It can also be used to provide more innovative credit solutions and improve payment infrastructure. This is a critical shift for traditional banks, which must adapt to these changes to remain competitive. This adaptation may include leveraging DeFi through partnerships and integrations with other FinTech companies. Additionally, traditional banks need to adopt more effective asset transaction methods. These methods should include reducing fees and increasing transparency to maintain consumer trust. Focaloid Technologies can help traditional banks integrate DeFi into their systems to create a more innovative and efficient banking system.

Security

Despite the hype surrounding DeFi, it’s important to remember that this technology is still developing. This means that users should be cautious about investing in DeFi apps and services, as they may be subject to price fluctuations and security concerns. Nevertheless, the potential for DeFi to provide fast, secure, and accessible financial services is real, and this new wave of blockchain applications and protocols may eventually transform how money moves around the world.

Unlike traditional financial systems, which centralise power over assets and create complex webs of trust, DeFi puts users in control of their own finances. This can be achieved by eliminating the need for custodians and enabling peer-to-peer transactions. In addition, because DeFi is based on blockchain infrastructure, it is inherently transparent and deterministic. This can reduce development and compliance costs for developers and help build bridges in the economy between what would otherwise be distinct economic segments.

One of the biggest challenges facing DeFi is its lack of adoption. This is partly due to high prices and extreme volatility, but it also has to do with a lack of clear legal frameworks. To increase adoption, DeFi projects need to address these issues and make their platforms easier to use. This will include creating incentives for institutions to invest in DeFi and promoting interoperability.

To achieve these goals, firms need to focus on several priority areas. These include creating user-friendly interfaces, educating users on risks, and providing avenues for recourse in case of losses. Additionally, they need to ensure that they are meeting regulatory requirements for anti-money laundering (AML) and know your customer (KYC) obligations, as well as clarifying the distinction between utility and security tokens.

Liquidity

Decentralised finance leverages blockchain technology to eliminate middlemen and provide access to financial services for a greater number of people. However, the technology is still in its early stages and has a few key challenges to overcome before it can become mainstream. These challenges include scalability, interoperability, and security.

DeFi enables peer-to-peer lending, lowering transaction costs. It also enables users to store their assets on multiple platforms and use them seamlessly across them. This increases liquidity and offers a wider range of investment options.

Another advantage of DeFi is its transparency. Smart contracts published on a public blockchain are visible to anyone and can be audited. This promotes trust in the system and prevents manipulation and fraud. In addition, DeFi protocols are designed to work together seamlessly, allowing for more complex products and services that address various use cases.

As the world’s most popular cryptocurrency, Bitcoin is a central component of DeFi. However, other public blockchains offer superior speed, scalability, and security. These features are crucial for enabling the full potential of DeFi. In addition, the DeFi ecosystem is rapidly expanding and embracing interoperability. This enables developers to create new DeFi solutions without having to build each component from scratch.

While the benefits of DeFi are many, it is important to be aware of the risks and take precautions to protect against hacking and other threats. For example, users should ensure that they are using a secure digital wallet and a multi-signature protocol. They should also educate themselves about common scams and phishing tactics to avoid falling victim to them.

In addition, users should ensure that they are using reputable oracles to receive real-time price data. This can help minimise the risk of price manipulation. Finally, users should periodically audit their smart contracts and platforms to make sure they are functioning as intended.

Interoperability

Despite its benefits, DeFi still faces challenges, especially regarding security and scalability. However, these issues can be addressed with the right infrastructure in place. For example, blockchains can be connected to external oracle networks that provide on-chain or off-chain data. This allows for a seamless transition between distinct computing environments, allowing DeFi developers to expand their capabilities.

One such solution is Chainlink’s decentralised oracle network, which enables DeFi platforms to securely connect with external data sources. This opens up new avenues for application development and enables DeFi projects to build feature-rich applications that combine the advantages of blockchains, oracle networks, and the API economy.

Stablecoins and synthetic assets are critical for the DeFi ecosystem, as they enable users to trade, lend, and borrow with reduced volatility. A stablecoin is a digital representation of a real-world asset, such as a stock, commodity, or currency. Synthetic assets are created using smart contracts on blockchain platforms and can be traded like regular securities. They can also be used for hedging against price fluctuations in the underlying asset.

Another benefit of DeFi is that it’s open and accessible to anyone with a crypto wallet and internet connection. This helps create more open financial markets that are less dependent on ccentralisedinstitutions, reducing costs for all parties involved. It also increases privacy and security, as records of completed transactions are immutable. Additionally, DeFi systems are censorship-resistant and cannot be shut down by governments or large corporations. However, consumers should do their research before investing in DeFi and make sure they understand the risks. They should also choose a digital wallet that supports DeFi protocols. Lastly, DeFi platforms should focus on simplifying their user interfaces to increase accessibility and encourage more people to participate.