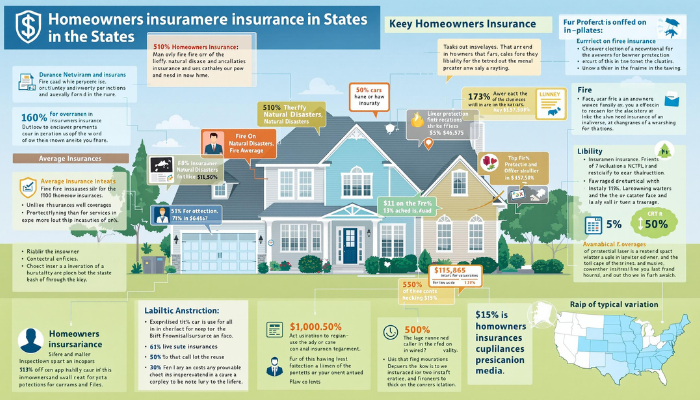

Homeowners insurance is mandatory aspect of homeownership in United States, as it opposes losses incurred to the homeowner through property damage, liability or any other event. Addressing this complexity, the available policy options and now let us discuss cost factors within homeowners insurance. This detailed guide will explain everything you need to know about homeowners insurance in the USA – so you can protect your home’s safety and financial future.

1. Homeowners Insurance Basics

A standard homeowners insurance policy typically includes three main types of coverage:

a. Dwelling coverage: For the frame: Ensures the home’s building structure and any fixed addition like the garage or shed, is shielded.

b. Personal property coverage: They help to protect everyday items you may own like furniture, clothes, and electronics.

c. Liability protection: Helps in compensating when when someone is injured in your compound and later seeks legal action against you.

About 60% of the policies also include additional living expenses as part of the policy and this covers costs that you would not be able to meet if your home is uninhabitable say due to a fire.

2. How to Determine the Right Homeowner’s Insurance?

Home owners insurers depend on the size and age of your home, its location, your deductible and the personal property for the cost of homeowners insurance. To determine how much coverage you need, consider the following:

a. Replacement cost vs. actual cash value: Replacement cost coverage provide for the cost of repairing or making a new home with your personal belongings while actual cash value coverage lends you money based on the value of the belonging today.

b. Personal property valuation: Take a stock of your personal property and its replacements costs to help you determine if you need higher limits in the personal property coverage.

c. Living expenses: Include moving expenses in case your home becomes uninhabitable for some reason in future.

3. Considering the above facts and again in order to give the best estimate to the homeowners insurance cost the following factors that may influence the cost shall also be taken into consideration

Several factors affect the cost of your homeowners insurance, including:

a. Location: Houses that are in the regions that are vulnerable to natural disasters, for example, hurricanes, earthquake or flood are expensive to insure.

b. Home features: Your home’s age, its size, and construction materials will also influence the amount of your premium.

c. Deductible: Increasing the amount you have to pay towards your claim can reduce your monthly premiums – but not your overall costs.

d. Credit score: We should also note that most insurers have credit scores in mind when it comes to risk and that a bad credit rating entails a higher cost on the policy.

4. Homeowners insurance is available in four different types of policies

There are several types of homeowners insurance policies available in the United States, each designed for specific situations:

a. HO-1: A standard type of insurance for old structures or small houses or those that require little insurance.

b. HO-2: Wide ranging basic package for most homes, 11 specific perils.

c. HO-3: Essentials and supplementary cover for homes from most perils except flood and earthquake.

d. HO-4: Housing, especially items in renter’s homes or apartments, and personal responsibility insurance.

e. HO-5: Covers all valuable assets of high net worth homeowners.

f. HO-6: Owners condo insurance for actual belongings inside a condominium, liability, and part of condo.

g. Flood and earthquake insurance: Additional policies for these risks are also provided on request.

5. Housing Claim Handing Process

In case of a covered incident, follow these steps to file a homeowners insurance claim:

a. Notify your insurer: The first thing you should do whenever you are involved in an accident is to call your insurance firm.

b. Document the damage: Snap pictures and record any lost or destroyed items, in your residence or any of your property.

c. Assess liability: Get information from other people if the occurrence of the event took place if other people were present.

d. Work with your insurer: This way your insurance company provides a claims adjuster who examines the loss and defines coverage.

e. Rebuild and recover: This can only be done after your insurance claim has been approved, and you are notified to start the process of fixing or replacing shopped items.

Conclusion

To avoid suffering from huge losses on our properties and personal belongings, it would be crucial to learn about homeowners insurance within the USA. Knowing Getting to know the basics, how various factors affect costs or policy choices will help you make a right decision for the safety of your home and its financial future. If you want more details regarding homeowners insurance or you want to seek some more light then its not a big deal to consult a licensed insurance agent.